KARACHI: After reaching an all-time high supported by a successful Shanghai Cooperation Organization (SCO) summit, the Pakistan Stock Exchange (PSX) faced renewed selling pressure on Thursday. This downturn was attributed to mounting political tensions surrounding the proposed 26th constitutional amendment, causing the KSE 100 index to fall below 86,000 due to aggressive foreign selling.

Ahsan Mehanti of Arif Habib Corporation commented that stocks closed under pressure amid political noise and uncertainty over judicial reforms, alongside significant foreign outflows. He also noted that government actions on Independent Power Producers (IPP) payments and tariff issues, weak global crude oil prices, and delays in the privatization of state-owned enterprises negatively impacted investor sentiment.

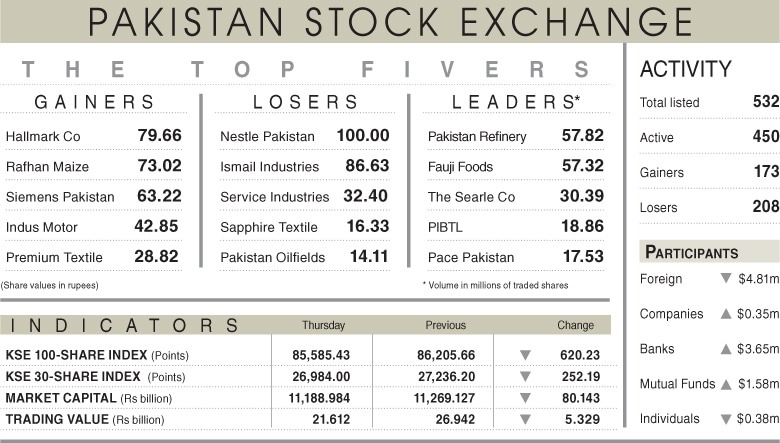

Topline Securities Ltd observed profit-taking in the banking and Exploration & Production (E&P) sectors, which collectively lost value, dragging the index down by 348 points. The KSE 100 index reached an intraday high of 86,520.29 and a low of 85,539.20, ultimately settling at 85,585.43 after losing 620.23 points, or 0.72% day-on-day.

However, trading volume increased by 8.21% to 513.28 million shares, while the traded value decreased by 19.78% to Rs21.61 billion.

Stocks significantly contributing to the traded volume included Pakistan Refinery (57.82m shares), Fauji Foods (57.32m shares), The Searle Company (30.39m shares), Pak International Bulk Terminal (18.86m shares), and Pace Pakistan (17.53m shares).

Shares registering the most significant price increases in absolute terms were Hallmark Company Ltd (Rs79.66), Rafhan Maize (Rs73.02), Siemens Pakistan (Rs63.22), Indus Motor (Rs42.85), and Premium Textile (Rs28.82).

Conversely, companies suffering significant price losses in absolute terms included Nestle Pakistan (Rs100.00), Ismail Industries (Rs86.63), Service Industries (Rs32.40), Sapphire Textile (Rs16.33), and Pakistan Oilfields (Rs14.11).

Foreign investors remained net sellers, offloading shares worth $4.81 million, while banks and mutual funds turned net buyers, acquiring shares worth $3.65 million and $1.58 million, respectively