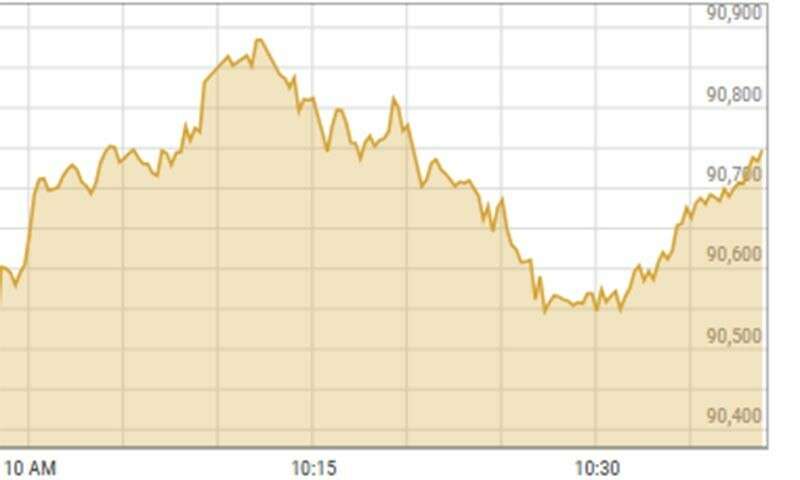

The Pakistan Stock Exchange (PSX) saw a powerful rally as the benchmark KSE-100 index soared over 800 points in early trading on Monday, crossing the 91,000 mark for the first time. By 10:42 a.m., the index had risen 855.89 points, or 0.95%, to reach 90,849.85 from Friday’s close of 89,993.96. As trading continued, the index briefly passed the 91,000 milestone, driven by strong investor confidence.

Market analysts attribute the sustained bull run to optimism around potential rate cuts by the State Bank of Pakistan (SBP) in upcoming Monetary Policy Committee (MPC) meetings set for November and December. Mohammed Sohail, CEO of Topline Securities, described the market activity as a “non-stop bull run,” fueled by strong corporate earnings and widespread expectations for a significant rate reduction.

Awais Ashraf, Director of Research at AKD Securities, pointed out that investor sentiment is being lifted by the possibility of lower interest rates and solid corporate performance. Sana Tawfik, Head of Research at Arif Habib Limited, echoed these views, highlighting the combination of anticipated rate cuts, robust corporate results, and increased liquidity as factors sustaining bullish momentum.

Last week, the market surged amid expectations of a substantial rate cut in the MPC meeting scheduled for November 4. A recent survey by Topline Securities showed that 85% of market participants anticipate a rate reduction of at least 200 basis points. Analysts at Topline Securities noted that this expectation is bolstered by a significant decline in inflation, with September’s reading at 6.9%—the lowest in recent months. October’s inflation is forecasted to remain in a range of 6.5% to 7.0%, reinforcing hopes for another policy rate cut.

With favorable economic indicators such as a declining inflation rate, manageable current account deficit, and rising remittances, most experts expect the SBP to announce its fourth consecutive rate cut since June, likely energizing the stock market further in the coming weeks.

ALSO READ: