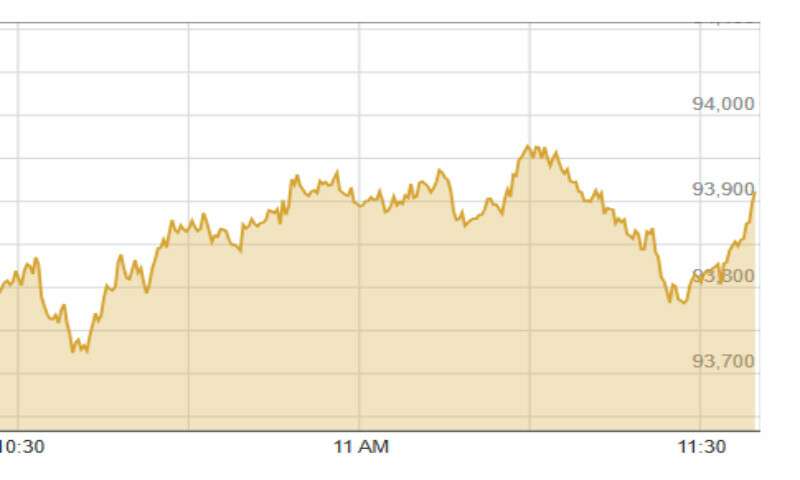

The Pakistan Stock Exchange (PSX) witnessed a strong comeback on Thursday, with the benchmark KSE-100 index surging more than 500 points in intraday trading. This surge followed a period of market fluctuations after the PSX’s record-breaking streak was interrupted earlier in the week.

PSX’s Recovery: A Positive Trend Amidst Market Volatility

After a slight pullback on Tuesday, which saw the market lose some ground, the PSX quickly regained momentum. On Thursday, the market bounced back significantly, with the KSE-100 index climbing by 548.58 points, or 0.59%, reaching 93,904.00 points by around 11:00 AM, from its previous close of 93,355.42 points.

Macro Economic Stability Paving the Way for Growth

Despite the global and domestic economic challenges, the outlook for the Pakistani stock market seems optimistic. According to Yousuf M. Farooq, the Director of Research at Chase Securities, the stability of macroeconomic indicators has played a crucial role in restoring investor confidence. “As returns in fixed-income mutual funds have declined, investors have increasingly turned their attention to equities,” Farooq noted.

He further pointed out that several positive factors, such as the halt in circular debt accumulation and increasing sales in sectors like automobiles and fast-moving consumer goods (FMCGs), were contributing to a favorable market sentiment.

Investor Sentiment: Strong Valuations Attracting Market Players

Farooq also emphasized the importance of long-term investment strategies. “Large rallies can sometimes lead to sharp, brief corrections,” he warned, advising investors to understand the reasons behind their stock purchases, especially considering that stocks are long-term instruments and not suitable for short-term needs.

Equity Market Outperforms Fixed-Income Assets

Awais Ashraf, the Director of Research at AKD Securities, commented on the favorable valuation of the KSE-100 index. He stated that the current environment, marked by declining fixed-income yields and falling commodity prices, is attracting investors back to the equity markets. The macroeconomic stability that has been building in recent months also plays a crucial role in this shift towards equities.

“The controlled current account deficit and the overall improved fiscal outlook, coupled with a positive review from the IMF board, have positioned Pakistan’s economy in a stronger position to secure more favorable terms from the IMF,” Ashraf stated.

Sectoral Performance: Growth in Key Industries

A few key sectors are leading the charge in the recovery of the stock market. The automotive industry, which has been witnessing a surge in sales, and the FMCG sector, both of which are generally considered key economic indicators, are contributing to the market’s growth. In addition, the real estate sector is showing signs of increasing activity, with many buyers feeling a sense of urgency to act before potential price hikes.

Market Outlook: What Investors Should Be Aware Of

Despite the optimism in the market, experts like Farooq and Ashraf caution that investors should remain vigilant. As the market heats up, there could be potential for short-term corrections. However, with positive trends in various economic indicators, the overall outlook for the stock market remains bullish in the long run.

Key Takeaways from PSX’s Recent Surge

- Positive Market Sentiment: Strong investor interest is being driven by favorable valuations and a stable macroeconomic environment.

- Sectoral Growth: Key sectors like automobiles, FMCGs, and real estate are contributing to the overall market strength.

- Investor Caution: While the market shows promise, experts recommend maintaining a long-term perspective and being mindful of short-term market fluctuations.

FAQs About the Recent PSX Surge

1. Why did the PSX surge by 500 points on Thursday?

The surge in the PSX is primarily attributed to the improved market sentiment driven by favorable valuations, stable macroeconomic indicators, and investor shifts from fixed-income assets to equities.

2. How are the automobile and FMCG sectors performing in the stock market?

Both the automobile and FMCG sectors are showing signs of growth, with increasing sales contributing to positive sentiment in these industries. The automotive sector, in particular, is witnessing rising sales, which is bolstering investor confidence.

3. What role does the IMF review play in the market’s recovery?

The positive review from the IMF has boosted market sentiment by signaling that Pakistan is on track for economic stabilization. This has contributed to investor optimism, particularly regarding the country’s fiscal outlook and its ability to negotiate favorable terms with international lenders.

4. Should investors be cautious about the recent market surge?

Yes, while the market shows strong potential, experts caution that large rallies can sometimes lead to brief, sharp corrections. It is essential for investors to approach the market with a long-term strategy and avoid short-term speculation.

5. What sectors are expected to drive the PSX’s growth in the coming months?

The automotive, FMCG, and real estate sectors are expected to remain key drivers of growth in the coming months, with signs of increased activity and consumer demand in these areas.

Conclusion: The Path Forward for PSX Investors

The recent surge in the PSX marks a positive trend for Pakistan’s economy and stock market. While there are short-term risks associated with market volatility, the long-term outlook remains promising, supported by strong economic indicators and growth in key sectors. Investors should focus on sustainable, long-term strategies, taking advantage of the opportunities presented by the market’s current conditions.