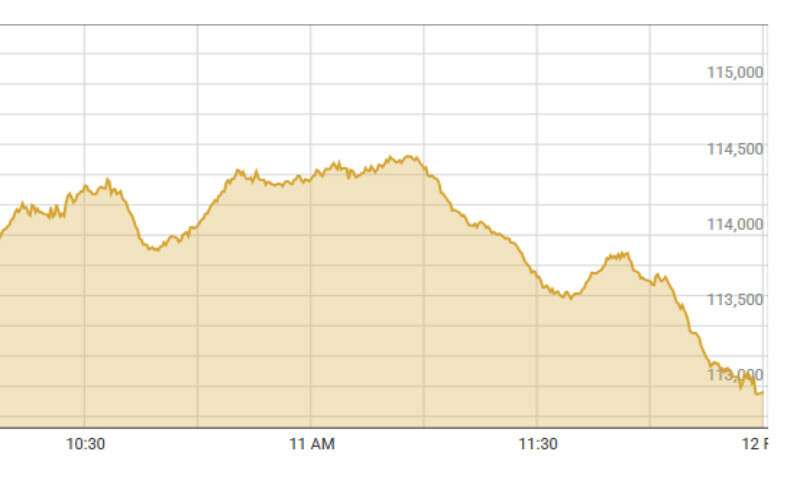

The Pakistan Stock Exchange (PSX) experienced a volatile trading session on Friday, with shares initially falling by a significant 1,200 points before rebounding towards the end of the day, showcasing the market’s resilience. The trading floor witnessed a classic tug-of-war between the bulls and bears, with investors reacting to fluctuating market conditions.

Intraday Movement: Bears Take Charge, Bulls Fight Back

The day began on a bearish note, with the benchmark KSE-100 index plunging by 1,216.86 points, or 1.07%, reaching a low of 112,963.64 points, down from the previous close of 114,180.50 points. This decline was primarily due to concerns over commercial bank share prices, which fell in anticipation of potential tax hikes. The fears were related to the government possibly increasing corporate taxes or altering the Advance-to-Deposit Ratio (ADR) definition, which could weigh heavily on the profitability of commercial banks.

However, the market showed strong signs of recovery as the day progressed, aided by support from key sectors such as Fertilizer and Exploration & Production (E&P). These sectors contributed more than 500 points to the overall index, helping to pull the market back into positive territory. By the end of the trading session, the KSE-100 index closed at 114,301.80 points, up by 121.3 points or 0.11% from its previous close.

Market Analysis: Reasons for the Fluctuation

Impact of Potential Tax Changes

The initial drop in the KSE-100 index was driven by investor concerns regarding higher taxes for commercial banks. Analysts are speculating that the government may either redefine the ADR or increase corporate tax rates. Commercial banks are particularly sensitive to such changes due to the nature of their business operations, which rely heavily on the lending-deposit spread. The announcement of any such measures could negatively impact the financial sector and, consequently, the overall market sentiment.

Fertilizer and E&P Sectors Provide Support

Despite the initial sell-off, the Fertilizer and E&P sectors performed strongly, providing a cushion to the index. The Fertilizer sector has long been a key player in the PSX, with companies in this space benefiting from strong domestic demand and favorable government policies. Similarly, the E&P sector saw positive momentum driven by global oil price trends and domestic production increases, helping to stabilize the market and mitigate the early losses.

Experts Weigh In: Normal Market Corrections

Several market analysts and experts weighed in on the PSX’s performance, providing reassurance to investors. Awais Ashraf, director of research at AKD Securities, noted that the market was under pressure due to the anticipated tax increases. However, he highlighted the resilience of the Fertilizer and E&P sectors, which helped the KSE-100 index recover some of the losses.

Yousuf M. Farooq, director of research at Chase Securities, suggested that the market was taking a “breather” after a significant rally. He reminded investors that market corrections are a normal part of the investment cycle and urged retail investors to look beyond short-term fluctuations and focus on long-term growth.

Record-Breaking Rally: The Rise of the KSE-100 Index

The PSX had recently experienced a historic rally, with the KSE-100 index surging by over 3,000 points in a single day. The index broke the 114,000-mark for the first time, marking one of its highest gains ever. Over the past 18 months, the KSE-100 index has experienced an extraordinary rise, going from around 40,000 points to over 112,000 points, delivering returns of approximately 180%. This rally has been fueled by a combination of factors, including strong corporate earnings, favorable government policies, and investor optimism.

What Investors Should Expect Moving Forward

Looking ahead, experts are mixed on the future trajectory of the market. While some predict further upward movement due to strong fundamentals in key sectors, others caution that volatility may persist due to macroeconomic factors such as inflation, tax policy changes, and global economic uncertainties. The market’s short-term fluctuations are expected, but long-term investors may continue to benefit from the overall positive outlook.

FAQs

1. What caused the significant dip in the PSX on Friday?

The dip was mainly caused by concerns over potential tax increases for commercial banks, which led to a decline in their share prices. This uncertainty around tax policy changes created downward pressure on the market.

2. How did the Fertilizer and E&P sectors help the market recover?

The Fertilizer and E&P sectors provided strong support by contributing over 500 points to the KSE-100 index. These sectors performed well due to favorable domestic conditions and global trends in energy prices.

3. Is the current market correction unusual?

No, market corrections are a normal part of the investment cycle. Experts believe that the market is simply taking a breather after a strong rally and that such fluctuations are typical in a volatile environment.

4. What is the future outlook for the KSE-100 index?

The future outlook remains positive in the long term, driven by strong sector performance and investor optimism. However, short-term volatility is expected due to potential changes in government policies and global economic conditions.

5. How can investors navigate market fluctuations?

Investors are advised to focus on long-term goals and avoid reacting impulsively to short-term market fluctuations. It is important to stay informed and consider the fundamentals of the market, rather than being swayed by daily price movements.

Conclusion: A Resilient Market Amid Volatility

Despite the significant intraday drop, the PSX demonstrated resilience, recovering by the end of the trading session. The market’s ability to bounce back is a positive indicator of investor confidence and the underlying strength of key sectors such as Fertilizer and E&P. While the short-term outlook may remain uncertain due to tax policy concerns, the long-term growth potential of the market remains strong, particularly for investors focused on fundamentals.

MUST READ

https://flarenews.pk/2024/12/13/zardari-delays-madressah-bill-amid-criticism/