Introduction

The Pakistan Stock Exchange (PSX) witnessed a remarkable surge, with the KSE-100 index climbing over 1,000 points. This bullish momentum has instilled confidence among investors, signaling a strong recovery after recent corrections. Market analysts believe this surge is driven by improving economic indicators, easing inflationary pressures, and growing optimism regarding future monetary policies.

KSE-100 Index Soars as Bulls Dominate

Market Performance Overview

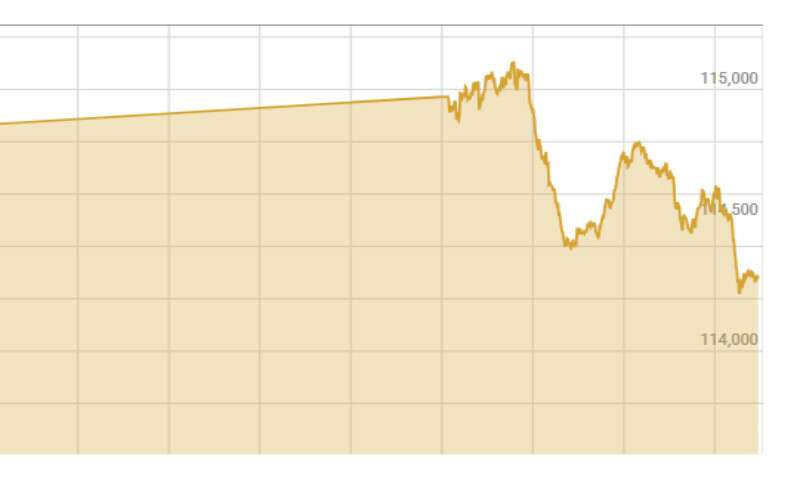

On Friday, the benchmark KSE-100 index surged by 1,096.00 points, marking an increase of 0.97%. The index climbed from its previous close of 113,206.40 to an intraday high of 114,302.40. By the end of the trading session, the index settled at 114,255.72, recording a net gain of 1,049.32 points or 0.93%.

This sharp rise marks a significant turnaround, breaking the market’s recent downward trend. The rally reflects renewed investor confidence as market participants anticipate further economic improvements.

Key Drivers Behind the Market Rally

Several factors have contributed to the bullish momentum in the stock market:

1. Economic Recovery and Improved Market Sentiment

The recent correction phase in the PSX allowed for fresh buying opportunities, attracting both institutional and retail investors. Analysts suggest that the market is stabilizing after previous fluctuations, creating a foundation for sustainable growth.

2. Declining Inflation and Interest Rate Expectations

The year-on-year Sensitive Price Index (SPI) has declined significantly, with projections indicating that the Consumer Price Index (CPI) may fall below 3%. This development increases the possibility of single-digit interest rates by 2025, making equities a more attractive investment option.

3. Anticipation of IMF Review and Economic Stability

With the next International Monetary Fund (IMF) review scheduled for March, investors are closely watching economic policies and fiscal decisions. A positive review could further strengthen Pakistan’s financial standing, increasing foreign investment inflows.

4. Strong Corporate Earnings Expectations

The stock market rally has also been fueled by strong earnings expectations, particularly in key sectors such as banking, energy, and technology. Investors are positioning themselves ahead of major corporate earnings reports, betting on positive financial results.

PSX Breaks Losing Streak

The recent bullish rally comes after a period of consecutive losses in the stock market. The PSX had experienced a three-session decline before reversing course due to aggressive value-hunting. Investors seized the opportunity to acquire stocks at lower valuations, leading to a surge in demand.

Market experts believe that speculative buying ahead of major earnings announcements has played a critical role in reversing the downward trend. Additionally, commitments from international investors and policy assurances have further bolstered confidence in the market.

Economic Indicators and Future Outlook

Monetary Policy Adjustments

The central bank has taken a proactive approach to managing inflation and stimulating economic growth. The recent reduction in the key policy rate is part of an ongoing strategy to encourage investment and support business expansion.

Since June, the policy rate has been lowered significantly, making it one of the most aggressive rate-cutting cycles among emerging markets. This move has been welcomed by investors, as lower interest rates reduce borrowing costs and promote economic activity.

Inflation Trends and Their Impact on PSX

The decline in inflationary pressures has been a major factor in boosting investor sentiment. As the cost of goods stabilizes, consumer confidence improves, leading to increased economic participation. If inflation remains under control, it could pave the way for further stock market growth in the coming months.

Challenges and Risks

While the PSX rally is a positive development, several risks remain:

- Rising Imports: A sudden spike in imports could widen the trade deficit, putting pressure on the country’s foreign exchange reserves.

- Excessive Government Spending: Unchecked fiscal expenditures could lead to inflationary pressures, impacting economic stability.

- Global Market Uncertainties: External factors such as geopolitical tensions, global recession fears, and commodity price volatility could impact investor sentiment.

Despite these challenges, market experts remain optimistic about the long-term outlook, provided that economic policies remain stable and investor confidence continues to strengthen.

Investor Sentiment and Market Trends

Sectoral Performance

Several key sectors contributed to the recent stock market rally. Among them, the banking sector has been one of the strongest performers, benefiting from stable interest rates and improved liquidity conditions.

The energy sector also witnessed significant gains, driven by expectations of policy reforms and resolution of circular debt issues. Additionally, the technology sector continues to attract investor interest due to its growth potential and increasing digital transformation efforts.

Foreign Investment Inflows

The Pakistan Stock Exchange has been receiving growing interest from international investors. With improving economic conditions and structural reforms, foreign investors are exploring opportunities in Pakistani equities. A positive IMF review could further enhance foreign participation in the market.

What’s Next for the PSX?

The stock market’s direction in the coming weeks will depend on several factors, including upcoming corporate earnings reports, economic policy decisions, and global market trends. Investors will closely monitor inflation data, interest rate movements, and government fiscal policies to assess future growth prospects.

FAQs

1. Why did the Pakistan Stock Exchange experience a sudden surge?

The PSX surge was driven by improved market sentiment, expectations of lower interest rates, positive economic indicators, and strong corporate earnings anticipation.

2. What role does the IMF review play in the stock market’s performance?

The upcoming IMF review is crucial as it will assess Pakistan’s economic policies and financial stability. A positive review could attract further investment and strengthen market confidence.

3. How does inflation impact the stock market?

Lower inflation reduces the cost of living and increases consumer spending, leading to economic growth. It also allows for lower interest rates, making stocks a more attractive investment compared to fixed-income securities.

4. What sectors are currently driving the PSX rally?

The banking, energy, and technology sectors have been key drivers of the recent stock market gains, benefiting from economic stability, policy reforms, and growth prospects.

5. What risks could affect the stock market’s performance?

Potential risks include rising imports, excessive government spending, global economic uncertainties, and policy changes that could impact investor confidence.

Conclusion

The Pakistan Stock Exchange has rebounded strongly, with the KSE-100 index climbing over 1,000 points in a single session. This bullish trend reflects improving economic conditions, declining inflation, and growing investor optimism.

While challenges remain, the overall outlook for the stock market remains positive, provided that economic policies remain stable and investor confidence continues to strengthen. With the IMF review on the horizon and corporate earnings season approaching, the PSX is expected to maintain its upward trajectory, offering opportunities for both domestic and international investors