Introduction

The Federal Minister for Finance and Revenue, Muhammad Aurangzeb, has emphasized the need for proactive efforts in achieving the objectives set by the Revenue Mobilisation, Investment, and Trade Programme (REMIT). Chairing a crucial meeting of the REMIT Steering Committee, Aurangzeb reviewed the progress made and called for a more dedicated approach to ensure the timely completion of the program’s goals.

Overview of REMIT Programme

What is the REMIT Programme?

The Revenue Mobilisation, Investment, and Trade (REMIT) Programme is a strategic initiative aimed at enhancing Pakistan’s economic sectors by focusing on revenue mobilisation, improving the investment climate, fostering trade, and strengthening macroeconomic governance. The program also integrates climate change initiatives, recognizing their importance in sustainable economic development.

Objectives of REMIT

- Revenue Mobilisation: Increasing government revenue through efficient tax collection and broadening the tax base.

- Investment Climate: Creating a conducive environment for both local and foreign investments.

- Trade: Promoting trade by removing barriers and enhancing competitiveness.

- Macroeconomic Governance: Ensuring stable and sustainable economic policies.

- Climate Change Initiatives: Integrating climate resilience into economic planning and execution.

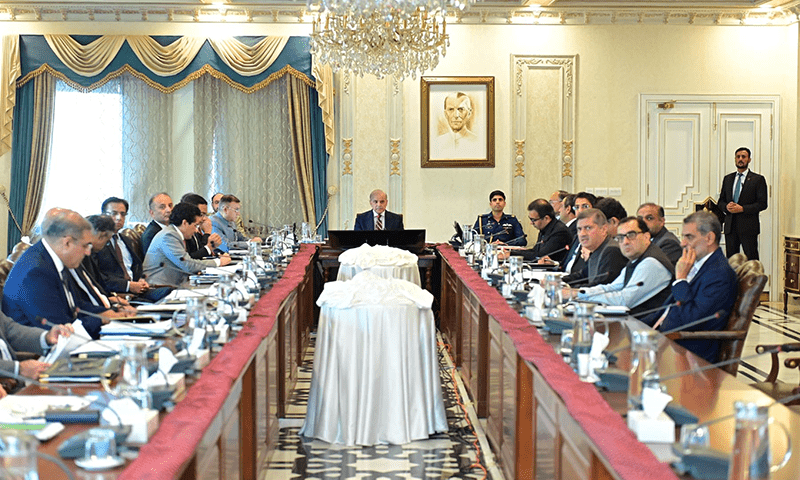

Progress Review Meeting

Leadership and Participation

Finance Minister Muhammad Aurangzeb chaired the REMIT Steering Committee meeting held in Islamabad. The meeting included key stakeholders from various economic sectors, who discussed the progress made on previously outlined decisions.

Key Areas of Focus

- Revenue Mobilisation: Efforts to enhance tax collection mechanisms and broaden the tax base were reviewed. Progress in implementing technology-driven solutions for tax administration was highlighted.

- Investment Climate: The committee discussed measures to improve the ease of doing business, including regulatory reforms and incentives for investors. Progress in attracting foreign direct investment (FDI) was also assessed.

- Macroeconomic Governance: The meeting focused on the effectiveness of current economic policies and their alignment with the REMIT objectives. The importance of maintaining economic stability and addressing fiscal deficits was underscored.

- Trade Enhancement: Initiatives to promote exports and reduce trade barriers were evaluated. The committee considered strategies to enhance the competitiveness of Pakistani products in international markets.

- Climate Change Initiatives: Integrating climate resilience into economic planning was discussed, with a focus on sustainable development practices and reducing the carbon footprint.

Commendations and Calls to Action

Minister Aurangzeb commended the progress made under the REMIT programme but stressed the need for more proactive and dedicated efforts from all stakeholders. He urged for a collaborative approach to ensure the timely execution of the program’s final deliverables.

Detailed Analysis of Key Sectors

Revenue Mobilisation

Current Efforts and Achievements

The REMIT programme has seen significant strides in revenue mobilisation. The introduction of technology-driven solutions for tax administration has streamlined processes, resulting in increased tax collection efficiency. The broadening of the tax base through policy reforms has also contributed to higher revenue generation.

Future Actions

To maintain momentum, the government plans to further enhance tax collection mechanisms and introduce more robust compliance measures. Encouraging voluntary tax compliance and reducing tax evasion remain top priorities.

Investment Climate

Enhancing the Business Environment

Creating a favorable investment climate is crucial for economic growth. The REMIT programme has focused on regulatory reforms to simplify business processes and reduce bureaucratic hurdles. Incentives for investors, including tax holidays and subsidies, have been implemented to attract FDI.

Attracting Foreign Direct Investment

Efforts to attract FDI have yielded positive results, with several international companies expressing interest in Pakistan. The government aims to continue these efforts by showcasing Pakistan as a lucrative investment destination through international roadshows and investment forums.

Macroeconomic Governance

Policy Effectiveness

The committee reviewed the effectiveness of current economic policies, highlighting the need for consistent and stable macroeconomic governance. Addressing fiscal deficits and maintaining economic stability are essential for sustained growth.

Future Policy Directions

The focus will be on implementing policies that ensure long-term economic stability. This includes prudent fiscal management, debt reduction strategies, and maintaining a favorable balance of payments.

Trade Enhancement

Promoting Exports

Removing trade barriers and enhancing the competitiveness of Pakistani products in international markets are key objectives. The REMIT programme has identified sectors with high export potential and is working on strategies to promote these industries.

Reducing Trade Barriers

Efforts to negotiate favorable trade agreements and reduce tariffs have been a priority. The government aims to continue these efforts to facilitate easier market access for Pakistani exporters.

Climate Change Initiatives

Integrating Climate Resilience

Recognizing the importance of climate resilience in economic planning, the REMIT programme has integrated climate change initiatives into its framework. Sustainable development practices and efforts to reduce the carbon footprint are being promoted.

Sustainable Development Practices

The focus is on implementing environmentally friendly practices across various sectors. This includes promoting renewable energy, sustainable agriculture, and eco-friendly industrial practices.

MUST READ:

https://flarenews.pk/2024/11/06/major-update-on-naseem-shah-ahead-of-second-australia-odi/

FAQs

1. What is the main goal of the REMIT programme?

The main goal of the REMIT programme is to enhance Pakistan’s economic sectors by focusing on revenue mobilisation, improving the investment climate, fostering trade, and strengthening macroeconomic governance, while also integrating climate change initiatives.

2. How does the REMIT programme plan to increase government revenue?

The REMIT programme plans to increase government revenue through efficient tax collection mechanisms, broadening the tax base, and introducing technology-driven solutions for tax administration.

3. What measures are being taken to attract foreign direct investment (FDI)?

Measures to attract FDI include regulatory reforms to simplify business processes, incentives for investors such as tax holidays and subsidies, and promoting Pakistan as a lucrative investment destination through international roadshows and investment forums.

4. How is the REMIT programme addressing trade barriers?

The REMIT programme is addressing trade barriers by negotiating favorable trade agreements, reducing tariffs, and implementing strategies to enhance the competitiveness of Pakistani products in international markets.

5. What are the climate change initiatives under the REMIT programme?

The climate change initiatives under the REMIT programme focus on integrating climate resilience into economic planning, promoting sustainable development practices, renewable energy, sustainable agriculture, and eco-friendly industrial practices.

Conclusion

The REMIT programme, under the leadership of Finance Minister Muhammad Aurangzeb, is making significant progress in enhancing Pakistan’s economic sectors. While commendable strides have been made, the call for more proactive and dedicated efforts highlights the ongoing commitment to achieving the programme’s ambitious goals. With a collaborative approach and continued focus on key areas, Pakistan is poised to realize the full potential of the REMIT programme.