Introduction

The Impact of KP’s Tax on Pak-Afghan Trade

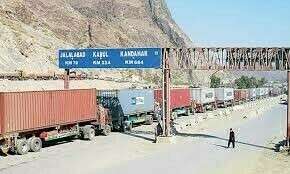

The imposition of a new tax on trade through Khyber Pakhtunkhwa (KP) and other restrictions are negatively affecting bilateral trade between Pakistan and Afghanistan, as well as trade with Central Asian States. Local traders have voiced their concerns over these new measures, highlighting the adverse impact on business growth and economic stability in the region.

Overview of the Tax and Restrictions

New Tax Policies

The Khyber Pakhtunkhwa (KP) government introduced a two percent infrastructure development cess (IDC) earlier this year. This tax applies to trade conducted through KP, and it has significantly impeded the growth of bilateral trade. Traders are now facing a “double taxation burden” as they are required to pay taxes on their imports both in Karachi and Peshawar, creating a competitive disadvantage for businesses based in KP.

Inconsistent Tax Policies Across Provinces

The president of the Pakistan-Afghanistan Joint Chamber of Commerce and Industry (PAJCCI), Junaid Makda, pointed out that inconsistent cess policies across various provinces have led to legal challenges and conflicts with the Afghanistan-Pakistan Transit Trade Agreement. This uneven regulatory environment is diverting trade away from KP, with Afghan traders exploring alternative routes through countries like Iran to avoid additional costs at Torkham.

Effects on Trade

Impact on Bilateral Trade

Mr. Makda highlighted that trade between Afghanistan and Pakistan has the potential to reach $7 billion. However, this potential is not being realized due to restrictive measures imposed by the government. The introduction of three Statutory Regulatory Orders (SROs) in October 2023 has further curtailed imports and exports between the two countries.

Specific SROs and Their Implications

- SRO 1380(I)2023: The federal government imposed a 10% processing fee on several items, including confectionaries, footwear, machinery, blankets, home textiles, and garments imported into Afghanistan through Pakistan.

- SRO 1397(I)2023: This order banned the import of tyres, black tea, dry fruits, fabrics, cosmetics, vacuum flasks, and home appliances through Pakistan.

- SRO 1402(I)2023: Introduced new regulations regarding bank guarantees for Afghan transit trade goods.

These measures have not only harmed the economy but have also threatened Pakistan’s standing as a regional trade leader.

Call for Uniform Policies

Advocacy for Consistent Policies

Mr. Makda emphasized the need for uniform cess policies aligned with federal guidelines to ensure a fair and stable trade environment. He advocated for a comprehensive action plan to remove the IDC and other trade barriers affecting Pakistan’s exports.

Support for Economic Cooperation

The PAJCCI, with the support of the Ministry of Commerce, is working to foster economic cooperation between Pakistan and Afghanistan. They are addressing cross-border trade challenges and advocating for policies that will enhance trade relations and economic growth in the region.

FAQs

What is the new tax imposed by the KP government?

The KP government has introduced a two percent infrastructure development cess (IDC) on trade through KP.

How has the new tax affected traders?

The new tax has created a “double taxation burden” for traders, who now have to pay taxes on their imports in both Karachi and Peshawar, leading to a competitive disadvantage for KP-based businesses.

What are the Statutory Regulatory Orders (SROs) issued in October 2023?

The three SROs issued are:

- SRO 1380(I)2023: Imposed a 10% processing fee on various items imported into Afghanistan through Pakistan.

- SRO 1397(I)2023: Banned the import of certain goods through Pakistan.

- SRO 1402(I)2023: Introduced new regulations for bank guarantees on Afghan transit trade goods.

How have these measures impacted Pakistan’s trade with Afghanistan?

These measures have restricted imports and exports, harming the economy and threatening Pakistan’s position as a regional trade leader.

What is PAJCCI’s role in improving trade relations?

The PAJCCI works with the Ministry of Commerce to foster economic cooperation between Pakistan and Afghanistan and address cross-border trade challenges.

Conclusion

Moving Forward

The imposition of new taxes and restrictive measures on trade through KP has significantly hindered the potential growth of bilateral trade between Pakistan and Afghanistan. To ensure a stable and fair trade environment, it is crucial to implement uniform cess policies aligned with federal guidelines. By removing trade barriers and fostering economic cooperation, both countries can work towards realizing the full potential of their trade relations.

MUST READ: