The Pakistan Stock Exchange (PSX) witnessed a spectacular surge on Friday, as the benchmark KSE-100 Index soared past the 98,000 mark and eventually surpassed the 99,000-point level during intraday trading. This sharp upward movement has become the focal point of market discussions, as bulls continue to drive market sentiment, making investors optimistic about the future trajectory of the stock market.

KSE-100 Index Hits New Heights

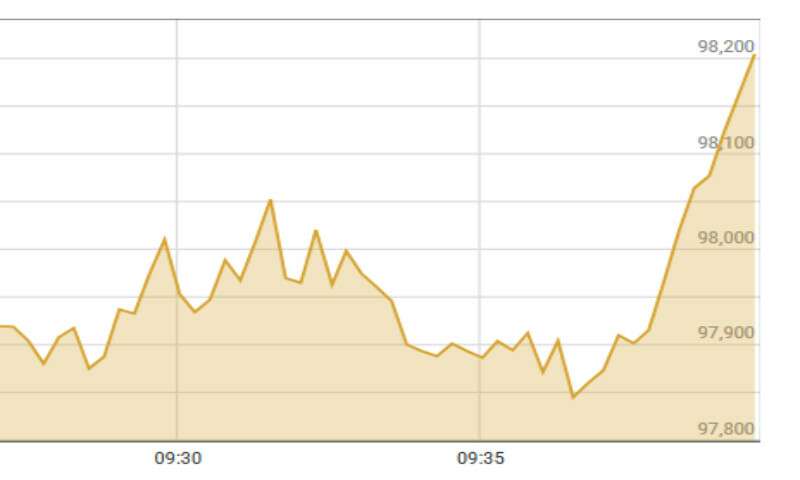

In a remarkable demonstration of bullish activity, the KSE-100 Index gained significant momentum on Friday. Starting at 9:50 AM, the index climbed 1,158.13 points, or 1.19%, reaching 98,486.52 points. But the excitement didn’t stop there; by 11:10 AM, the market surged further, with the KSE-100 index soaring by over 2,000 points, hitting 99,385.79 points, breaking through key resistance levels.

Although the final close saw the index settle at 97,798.23 points — an increase of 469.84 points or 0.48% — the intraday surge marked a record-high for the market, indicating strong bullish sentiment among investors.

Factors Behind the Surge: Institutional Interest and Political Stabilization

The rapid ascent of the KSE-100 Index can be attributed to several key factors. According to Awais Ashraf, Director of Research at AKD Securities, the strong performance of the market is primarily driven by a combination of subsiding political risks and a surge in institutional interest. The easing of interest rates has further buoyed investor sentiment, making stocks more attractive to institutional investors.

Attractive Price-to-Earnings Ratio

Ashraf further emphasized that the market is currently trading at a price-to-earnings (P/E) ratio of 4.7x, which is significantly lower than its 10-year average of 7.2x. This suggests that there is considerable upside potential, with the market poised for at least a 55% increase if the P/E ratio reverts to its long-term average. Additionally, the market’s current dividend yield of 10.5% adds to the appeal, especially for long-term investors seeking consistent returns.

Political Stability: A Key Driving Force

Yousuf M. Farooq, Director of Research at Chase Securities, pointed out that reports of discussions between the army chief and the business community have contributed to the positive sentiment. The army chief reassured the business community about both economic and political stability, which has led to a reduction in political uncertainty.

Over the past few weeks, political risk has been one of the biggest concerns for investors. The recent signals of political stability have provided a sense of reassurance, thereby fueling market liquidity. This reduction in political risk is seen as a major driver behind the inflow of capital into the stock market.

Macroeconomic Factors: The Bullish Underpinnings

Sana Tawfik, Head of Research at Arif Habib Limited, attributed the ongoing bull run to several positive macroeconomic indicators. The country’s inflation rate, which is expected to remain between 4.5% and 5% in November, is the lowest it has been since April 2018, when it registered around 3.96%. This lower-than-expected inflation rate has been a key factor in bolstering market confidence.

Current Account Surplus

In addition to inflation, the market is also being supported by a current account surplus, which has eased concerns over the country’s external account position. This has, in turn, encouraged institutional investors and mutual funds to ramp up their buying activities, further contributing to the bullish trend in the market.

Institutional Investors Drive the Rally

The current market rally has seen a shift in investor behavior. While individual investors have shown some caution due to ongoing political uncertainty, institutional investors are leading the charge. Analysts note that institutions are actively building their equity portfolios, motivated by the declining yields on fixed-income instruments and growing confidence in the country’s macroeconomic outlook.

One of the driving forces behind this institutional activity has been the unlocking of dividends by major companies like Fauji Fertilizer Company (FFC) and Fauji Fertilizer Bin Qasim Limited (FFBL). This has overshadowed political concerns and provided a boost to investor sentiment, further fueling the market’s upward trajectory.

Record Highs at PSX: A Sign of Optimism

The recent bull run has not been a one-off event. Over the past few weeks, shares at the PSX have consistently hit new record highs, reflecting a steady recovery and growing optimism among investors. Analysts attribute this surge to the stabilizing macroeconomic conditions in the country.

As inflation is expected to hover between 5% and 6% in November, market participants are anticipating another rate cut, which would further enhance the market’s appeal. The improving economic outlook, combined with a stable political environment, has created an ideal environment for the stock market to thrive.

Caution Amid Optimism: The Risks Ahead

While the ongoing rally has been impressive, analysts caution that certain risks remain. The market’s current valuations are no longer as low as they were last year, but they are still considered reasonable, given the improving macroeconomic indicators. However, some risks to the continued bullish momentum include potential political instability, macroeconomic shocks, excessive government spending, and a deteriorating current account position.

Despite these risks, analysts remain optimistic, emphasizing the importance of a long-term investment strategy. Retail investors, in particular, are advised to maintain a diversified portfolio and focus on consistent, long-term investing to weather any short-term fluctuations in the market.

FAQs

1. What is driving the recent surge in the KSE-100 Index?

The surge in the KSE-100 Index is driven by a combination of subsiding political risks, easing interest rates, and strong institutional buying activity. Positive macroeconomic indicators, such as low inflation and a current account surplus, are also contributing to the bullish sentiment.

2. How can retail investors benefit from the current market rally?

Retail investors are advised to adopt a long-term investment strategy, focusing on consistent monthly investments in a diversified portfolio. This approach can help mitigate short-term fluctuations and benefit from the long-term growth potential of the market.

3. What is the P/E ratio, and why is it important for investors?

The P/E ratio is a valuation metric that compares a company’s current share price to its earnings per share. A lower P/E ratio suggests that a stock may be undervalued, offering potential for price appreciation. The current market P/E ratio of 4.7x indicates significant upside potential for the market.

4. What are the main risks to the KSE-100 Index’s upward momentum?

Key risks include political instability, macroeconomic shocks, excessive government spending, and a deteriorating current account position. These factors could potentially derail the ongoing rally in the market.

5. How are institutional investors influencing the market?

Institutional investors are playing a crucial role in driving the current bull run by actively building equity portfolios. Their involvement, combined with declining fixed-income yields and improving economic conditions, has provided significant liquidity to the market.

Conclusion

The KSE-100 Index’s recent surge highlights a remarkable shift in investor sentiment, driven by a combination of political stability, improving macroeconomic indicators, and strong institutional interest. While caution remains advisable due to potential risks, the current market environment offers promising opportunities for long-term investors.

MUST READ: