Introduction

In Islamabad, a significant dispute has arisen between the Finance Ministry and the Petroleum Division regarding the implementation of a critical International Monetary Fund (IMF) condition to cut gas supplies to industrial electricity plants by January. This disagreement underscores the challenges and poor negotiations surrounding the $7 billion IMF deal, with both ministries blaming each other for the potential fallout.

The Core Issue

Finance Ministry vs. Petroleum Division

During a high-level meeting at the Prime Minister’s house, the Petroleum Division expressed its concerns that the Finance Ministry accepted the IMF’s condition to cut gas supplies despite reservations. The Petroleum Division highlighted that this abrupt disconnection could result in a massive Rs427 billion loss to the government and industries. In contrast, the Finance Ministry insists that the Petroleum Division was fully aware and supportive of the condition during negotiations and is now backtracking.

Power Division’s Assessment

The Power Division has assessed that the complete transition of industries from gas to electricity would require approximately two years. This assessment casts doubt on the feasibility of meeting the January 31, 2025 deadline for gas disconnections, suggesting that the initial agreement may not have been thoroughly considered.

Escalating Dispute

Meetings and Tense Discussions

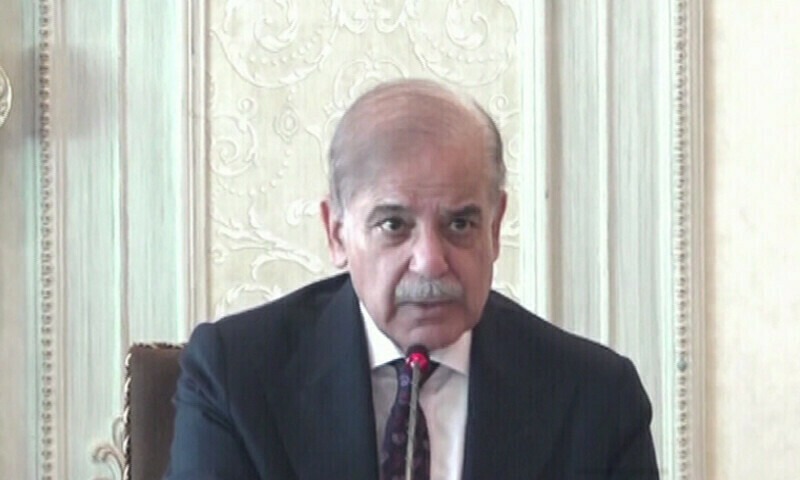

Despite the escalation of the dispute to Prime Minister Shehbaz Sharif’s level, the key players have not resolved their differences. The Prime Minister has chaired at least two meetings on the issue, and four meetings with the IMF were held in the past week. Sources reveal that tensions ran high during a recent meeting at the PM’s house, with one minister aggressively defending his position.

IMF’s Structural Benchmark

As part of the approximately 40 conditions agreed upon for the $7 billion package, Pakistan committed in September to permanently cease gas supply for in-house power generation by industries. However, within weeks, disagreements have emerged between the ministries.

Potential Economic Impact

The Petroleum Division estimates that the sudden disruption of gas supplies could result in hundreds of billions of rupees in losses, including the Rs100 billion cross-subsidy recovered from industrial consumers to provide cheaper gas to residential users.

IMF’s Gas Sector Reforms

Focus on Price Normalization

The IMF’s gas sector reforms aim to normalize prices across sectors and eliminate captive power generation. The goal is to shift industrial consumers to the national electricity grid, boosting declining electricity consumption, channeling scarce gas resources to more efficient gas-based power generators, and reducing power generation costs.

Differing Perspectives

The Finance Ministry asserts that it took the Petroleum Division into confidence before finalizing the structural benchmark with the IMF, sharing initial drafts of the agreement in May-June and incorporating concerns. However, the Petroleum Division claims it consistently conveyed the difficulty of implementing the condition by January 2025.

Cabinet Committee on Energy (CCOE) Directive

In 2021, the CCOE directed the phase-out of gas supplies to captive power plants. Despite this, the government increased LNG imports for industrial use in 2023 and secured a deal with Qatar for 48 extra LNG cargoes, resulting in a gas surplus that now needs utilization.

The Shift to National Grid

Raised Captive Power Tariffs

The government has raised captive power tariffs and eliminated the distinction between export and non-export industries by redefining consumer categories as “industrial process” and “industrial captive power.” However, the assumption that industries will shift to the national grid after gas supply discontinuation may not hold, as industries might opt for alternative energy sources.

Idle Capacity Payments

Currently, consumers pay about Rs18.50 per unit in idle capacity payments. The Finance Ministry and IMF believe this can be reduced by increasing consumption. However, these policies have driven many residential and industrial consumers to shift to alternative energy sources, questioning the effectiveness of the IMF, World Bank, and government strategies.

Conclusion

The dispute between the Finance Ministry and the Petroleum Division over IMF gas reforms highlights the complexities and potential economic repercussions of such policies. As the January 31, 2025 deadline looms, it remains uncertain how these challenges will be addressed and whether a resolution can be found to prevent significant economic losses and industry disruption.

FAQs

1. What is the main issue between the Finance Ministry and the Petroleum Division?

The main issue is the implementation of an IMF condition to cut gas supplies to industrial electricity plants by January 2025. The Petroleum Division claims the Finance Ministry accepted this condition without considering the potential economic impact.

2. What are the potential economic losses if gas supplies are cut abruptly?

The Petroleum Division estimates that sudden gas supply disruption could result in a Rs427 billion loss, including a Rs100 billion cross-subsidy from industrial consumers to provide cheaper gas to residential users.

3. What is the IMF’s objective with the gas sector reforms?

The IMF’s gas sector reforms aim to normalize prices across sectors, eliminate captive power generation, shift industrial consumers to the national electricity grid, boost declining electricity consumption, channel scarce gas resources to more efficient gas-based power generators, and reduce power generation costs.

4. How long does the Power Division estimate it will take to transition industries from gas to electricity?

The Power Division estimates that it will take approximately two years to completely transition industries from gas to electricity.

5. What steps has the government taken to address the gas supply issue?

The government has raised captive power tariffs, eliminated the distinction between export and non-export industries, and secured a deal with Qatar for 48 extra LNG cargoes. However, these measures may not fully address the challenges posed by the IMF condition.

SEE ALSO: