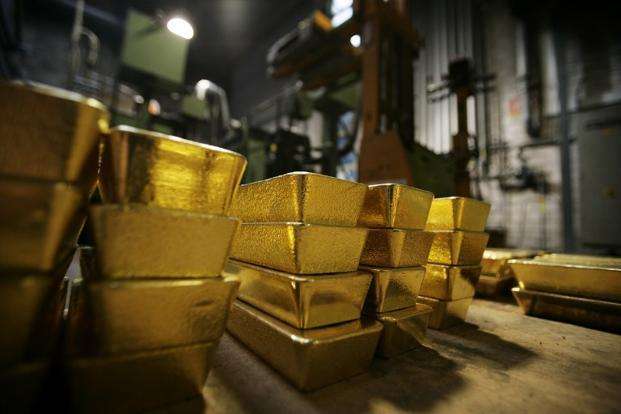

Introduction to Gold Price Fluctuations

Gold prices have experienced notable fluctuations in both international and local markets recently. This trend is not unusual and is influenced by various factors such as market demand, global economic conditions, and geopolitical tensions. The price of silver, however, has remained stable, showing a contrast in the market behavior of these two precious metals.

International Market Dynamics

Decline in Gold Prices

In the international bullion market, the price of gold fell by $11, reaching $2,650 per ounce. This decline has had a direct impact on local gold markets, leading to a decrease in the price of 24-carat gold per tola by Rs 1,100, bringing it down to Rs 276,200. Similarly, the price of 10 grams of gold also saw a decrease, falling by Rs 943 to Rs 236,797.

Stability in Silver Prices

Contrasting with the fluctuations in gold prices, the price of silver has remained unchanged. The per tola price of silver stayed at Rs 3,400, and the 10-gram price of silver remained stable at Rs 2,914.95. This stability suggests a different market dynamic for silver compared to gold.

Local Market Trends

Recent Rebound in Gold Prices

In Pakistan, gold prices rebounded by Rs 2,100 to Rs 277,300 per tola (11.66 grams) on Friday, aligning with trends in the international market. This increase followed a Rs 700 dip on Thursday, which had brought the price down to Rs 275,200 per tola. The All Pakistan Sarafa Gems and Jewellers Association reported this rebound, reflecting the volatility and rapid changes in gold prices.

Expert Analysis

Adnan Agar, Director of Interactive Commodities, commented on these fluctuations, noting that such price swings are expected in Pakistan’s gold market. He explained that $25 price swings are common in global gold trading, and the overall market trend remains bullish. Investors often capitalize on these price dips, seeing them as buying opportunities.

Factors Influencing Gold Prices

Global Economic Conditions

Gold prices are often influenced by global economic conditions. A weaker US dollar, for instance, can support higher gold prices as it makes gold cheaper for buyers holding other currencies. Additionally, geopolitical concerns can drive investors to seek safe-haven assets like gold, further impacting its price.

Market Trends and Investor Behavior

Market trends and investor behavior also play a crucial role in gold price fluctuations. As noted by Adnan Agar, the bullish trend in the market suggests that investors are looking for opportunities to buy gold during price dips, anticipating future gains.

Current Market Scenario

Recent Performance

In the international market, gold prices rose on Friday, supported by a weaker US dollar and ongoing geopolitical concerns. Spot gold climbed 0.7% to $2,659.49 per ounce but recorded a weekly decline of about 2% after a sharp sell-off earlier in the week. Similarly, US gold futures increased by 0.8% to $2,659.20 per ounce.

Implications for Local Markets

These international trends have direct implications for local markets. The rebound in gold prices in Pakistan mirrors the international rise, indicating a strong correlation between global and local market dynamics.

Conclusion

The gold market is characterized by its volatility, with prices influenced by a range of factors including global economic conditions, geopolitical concerns, and investor behavior. While gold prices have recently dipped in both international and local markets, the overall trend remains bullish, with investors keen to capitalize on price dips.

FAQs

What caused the recent dip in gold prices?

The recent dip in gold prices can be attributed to various factors, including fluctuations in the international bullion market, a stronger US dollar earlier in the week, and general market volatility.

Why did the price of silver remain unchanged?

The price of silver remained unchanged due to different market dynamics compared to gold. The demand and supply factors for silver can differ, leading to stability even when gold prices fluctuate.

How do global economic conditions affect gold prices?

Global economic conditions, such as the strength of the US dollar and geopolitical concerns, significantly affect gold prices. A weaker dollar typically makes gold cheaper for international buyers, increasing demand and prices.

What is the significance of the rebound in gold prices in Pakistan?

The rebound in gold prices in Pakistan indicates a strong correlation with international market trends. It suggests that local prices are influenced by global market dynamics and investor behavior.

Should investors consider buying gold during price dips?

Yes, investors often see price dips as opportunities to buy gold at a lower cost, anticipating future price increases. This strategy is common in bullish markets where the overall trend is expected to rise.

ALSO READ: