The Pakistan Stock Exchange (PSX) experienced a massive surge on Monday, with shares gaining over 3,900 points. Investors’ optimism about the possibility of key interest rates falling to single digits in the near future contributed to this record rally. This article delves into the causes, impact, and future expectations for the PSX following this phenomenal performance.

Overview of the Rally at PSX

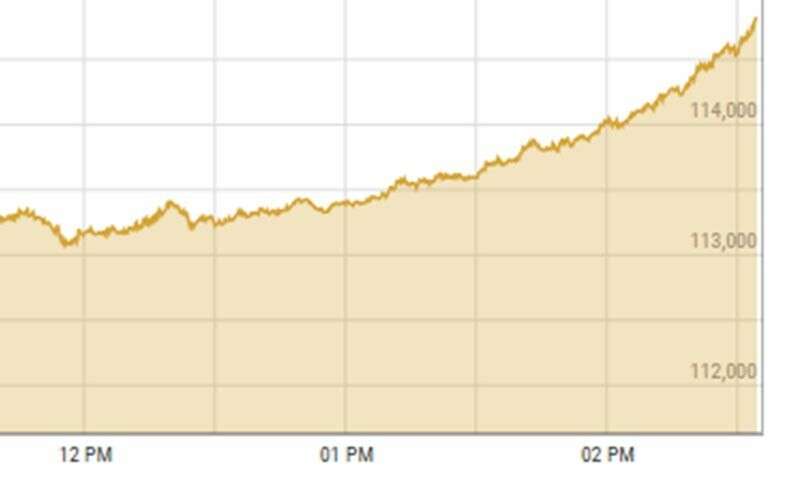

The Pakistan Stock Exchange witnessed a rare, substantial rally on Monday, with the benchmark KSE-100 index gaining an impressive 3,907.82 points, closing at 115,258.99. This surge represents a 3.51% increase from the previous session, marking the third-largest single-day point-wise rally in the PSX’s history. At one point during the day, the KSE-100 index had climbed by 3,678.20 points, or 3.30%, reaching a level of 115,029.37 by 3:09 pm, showing a substantial increase from the previous close of 111,351.17.

What Led to the Surge?

The rally was primarily driven by investors’ expectations that interest rates would fall significantly in the near future, possibly reaching single digits in 2025. Analysts believe that a strong external account position and improving macroeconomic conditions, coupled with a successful rollover of futures, contributed to this upbeat performance. Additionally, year-end portfolio adjustments by institutional investors helped push the index higher as they aimed to close their portfolios on a positive note.

Awais Ashraf, Director of Research at AKD Securities, explained that the year-end dynamic of institutions seeking to close their portfolios at higher levels played a significant role in fueling the rally. The rollover of futures contracts also added further momentum to the market.

Institutional Activity and Market Dynamics

The Role of Futures Contracts

A key driver behind this rally was the successful rollover of around Rs 55 billion in futures contracts. Futures contracts are agreements to buy or sell a specific asset at a set price in the future. Toward the end of each month, individuals and institutions holding positions in futures contracts need to either clear their positions by purchasing stocks from the ready market or roll over their contracts to the following month. This activity in the futures market often creates additional demand for stocks in the ready market, leading to upward pressure on stock prices.

Ashraf noted that this process, coupled with investor optimism, fueled the rally. Institutional buying activity, combined with strong sentiment surrounding future interest rate cuts, added fuel to the market fire.

Impact of Falling Interest Rates

Ashraf further explained that the anticipated fall in interest rates would contribute significantly to the performance of the PSX. He noted that interest rates were expected to decrease to single digits in 2025, which would be beneficial for the stock market. With alternative investments such as fixed deposits or bonds offering diminishing returns, equities are expected to become the preferred asset class, driving investor demand and potentially resulting in a strong rally in the years ahead.

The outlook for the PSX remains optimistic, with Ashraf forecasting the KSE-100 index could reach 165,215 by December 2025. This would represent a 45% return, or a 41% return in USD terms, which would be a significant gain for investors.

Government’s Role in Market Optimism

Finance Minister’s Remarks

The rally was also spurred by remarks from Pakistan’s Finance Minister, Muhammad Aurangzeb, who predicted that inflation would likely remain between 4-5%, signaling the possibility of single-digit interest rates in the near future. His comments, coupled with a general sense of confidence regarding the economy’s future stability, helped further boost investor sentiment.

The Finance Minister emphasized that macroeconomic stability had been achieved in the past six months, providing a solid foundation for sustainable growth in the future. While he acknowledged that Pakistan was still an “import-led economy,” he stressed the importance of transitioning toward export-led growth. The groundwork laid in 2024 could help pave the way for a more resilient and self-sustaining economy in 2025, contributing to overall market growth.

Expectations for the Future

Looking ahead, market analysts and investors have strong expectations for the future of the PSX. The success of structural reforms, along with continued fiscal and monetary discipline under the International Monetary Fund (IMF) program, is likely to support the market’s positive trajectory. Many experts predict that equities will become more attractive as alternative investment returns decline, leading to further gains in the stock market.

Awais Ashraf from AKD Securities stated that a continued focus on structural reforms and fiscal consolidation will play a key role in improving the investment climate. These efforts, alongside a favorable interest rate environment, will likely drive the PSX to new heights in the coming years.

Understanding the Broader Economic Context

Role of Inflation and Interest Rates

The relationship between interest rates and inflation is critical when analyzing the performance of a country’s stock market. High interest rates typically result in higher borrowing costs, which can dampen business investment and consumer spending. Conversely, lower interest rates often lead to greater economic activity as borrowing becomes cheaper, boosting corporate profits and stock market performance.

Finance Minister Muhammad Aurangzeb’s comments regarding inflation and interest rates indicate that the country’s economic fundamentals are improving, and investors are now looking forward to the potential benefits of lower rates. If inflation continues to remain low and interest rates decline as predicted, investors may increasingly turn to the stock market as a more attractive investment avenue.

External Factors and Economic Growth

As Pakistan’s economy moves toward a more balanced and export-driven model, external factors such as global trade, foreign investments, and international market trends will also play a role in shaping the performance of the PSX. A stable and growing economy, paired with favorable external conditions, can provide the much-needed support for further market rallies.

FAQs

1. Why did the PSX experience such a significant rally?

The PSX rally was driven by investor optimism regarding the possibility of falling interest rates, strong external account conditions, and institutional buying activity toward the end of the year.

2. How does the rollover of futures contracts impact the stock market?

The rollover of futures contracts creates additional demand for stocks in the ready market, as investors either clear their positions or roll over their contracts, pushing stock prices higher.

3. What is the expected future performance of the KSE-100 index?

Experts predict that the KSE-100 index could reach 165,215 by December 2025, providing investors with a 45% return, or a 41% return in USD terms.

4. What role does inflation play in the stock market performance?

Inflation directly impacts interest rates and consumer behavior, influencing corporate profits and stock market performance. Lower inflation often leads to lower interest rates, which can boost stock prices.

5. How does the IMF program affect the PSX?

The IMF program focuses on structural reforms, fiscal consolidation, and monetary discipline, which improves the investment climate and supports the growth of the stock market.

Conclusion

The Pakistan Stock Exchange’s third-largest single-day rally is a testament to the optimistic outlook for the market in the coming years. Fueled by investor expectations of lower interest rates and a more stable economic environment, the PSX is poised for continued growth. With strong institutional activity, favorable government policies, and a focus on structural reforms, the PSX offers significant potential for investors seeking long-term gains.

ALSO READ

https://flarenews.pk/2024/12/30/snapdragon-7s-gen-2-vs-exynos-1330-vs-helio-g100/