PM Defers Decision on Tax Relief for Ailing Sector

Introduction

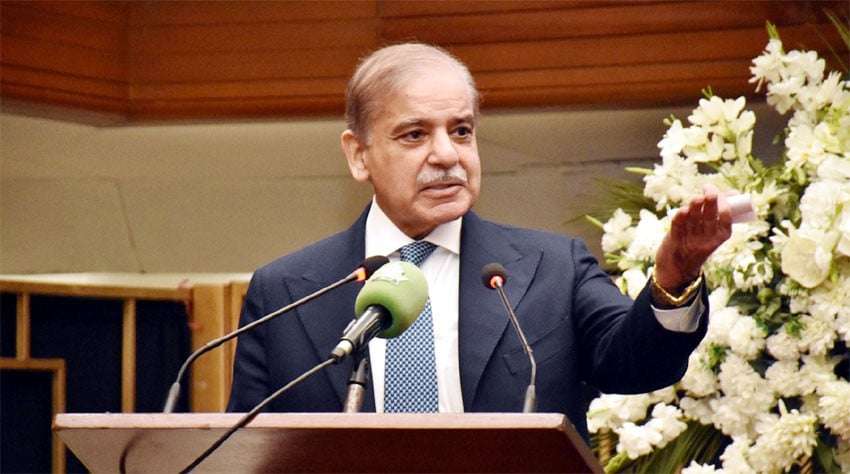

The revival of Pakistan’s real estate sector remains uncertain as Prime Minister Shehbaz Sharif has deferred a crucial decision on a tax incentive package. This delay is due to unresolved issues, including a proposed subsidy for construction activities and an amnesty for undisclosed income sources. While discussions continue, the International Monetary Fund (IMF) remains firm on its stance against any form of tax amnesty.

Tax Amnesty Proposal and IMF’s Stance

A businessman proposed a tax amnesty of up to Rs50 million for first-time buyers of homes, shops, or offices. However, the Federal Board of Revenue (FBR) strongly opposed this proposal, citing the IMF’s persistent opposition to amnesty schemes. Given Pakistan’s financial commitments to the IMF, the government is wary of taking steps that could violate prior agreements.

Housing Sector Task Force Meeting

A housing sector task force convened with Prime Minister Shehbaz Sharif to discuss potential measures for stimulating the real estate market. Key proposals included:

- Reduction of property transaction taxes.

- Abolishment of federal excise duty.

- Introduction of interest-rate subsidies for home loans.

- Amnesty for first-time home buyers.

Government sources revealed that although there was broad consensus on reducing taxes, major decisions were deferred due to unresolved concerns.

FBR’s Position on Taxation

The FBR chairman supported abolishing the 3% federal excise duty, which has been a contentious issue. The FBR argued that the levy on homes built and resold multiple times goes beyond legal provisions. Many taxpayers have already contested this tax in court.

IMF Consultation and Economic Affairs Minister’s Role

The Prime Minister has assigned Economic Affairs Minister Ahad Khan Cheema the responsibility of refining the proposed relief package and engaging the IMF for approval. The task force also explored lowering property sale and purchase taxes, eliminating federal excise duties, and potentially subsidizing home construction loans.

Concerns Over Speculation in Real Estate

Some task force members expressed concerns that an amnesty package might lead to money laundering and speculative investments. Historically, tax amnesties in real estate have resulted in inflated property prices, making housing unaffordable for lower-income groups.

Arif Habib, a prominent Pakistani businessman, argued that first-time home buyers should not be required to disclose income sources for amounts up to Rs50 million. He asserted that this does not classify as a full-fledged amnesty but rather as an incentive for genuine home buyers. The FBR chairman, however, rejected this claim, maintaining that it still constitutes a tax amnesty, which the IMF would not approve.

Challenges in the Real Estate Market

Pakistan’s real estate market faces multiple challenges, including:

- High Transaction Taxes: Even tax-compliant property buyers (filers) must pay around 8% of the property value in taxes.

- Undervaluation of Properties: Due to high taxation, buyers often declare property values lower than their actual worth.

- Cash-Based Transactions: The informal economy leads to unregistered transactions to avoid tax scrutiny.

- Limited Corporate Investment: The corporate sector and banks are reluctant to undertake large-scale construction projects due to the lack of regulatory transparency.

Government’s Plan for Real Estate Revival

The Prime Minister directed officials to engage with Arif Habib to find a middle ground that could encourage investment while maintaining regulatory integrity. Business leaders will also engage with the IMF next month to discuss the proposed amnesty scheme.

FBR Chairman Rashid Langrial noted that while consensus exists on providing relief to the real estate sector, the legal framework for such measures remains undecided. A key legal amendment requiring upfront disclosure of income sources for property purchases was recently postponed, providing temporary relief to real estate investors.

The Need for Regulatory Reforms

Pakistan’s real estate sector remains largely unregulated. Major concerns include:

- Illegal Housing Societies: Agricultural land is frequently converted into housing projects without proper regulatory approvals.

- Oversupply of Plots: More plots exist in the market than the actual demand, causing price distortions.

- Escrow Accounts for Construction: Experts recommend implementing escrow accounts to regulate construction projects and prevent overselling of apartments and plots.

Interest Rate Subsidies for Home Loans

To facilitate lower and middle-income groups, the government is considering providing interest rate subsidies on home loans. The Economic Affairs Minister has been tasked with formulating a detailed proposal within a week.

During his tenure, former Prime Minister Imran Khan introduced an interest-rate reduction subsidy for lower-middle-income groups, which successfully helped many individuals own homes. However, despite the central bank’s policy rate being set at 12%, home loan interest rates remain above 17%, making borrowing expensive.

Fiscal Pressure on the Salaried Class

While relief measures for the real estate sector are being debated, the salaried class continues to face heavy taxation. Between July and January of the current fiscal year, salaried individuals paid Rs285 billion in income tax—Rs100 billion more than the previous year. The government has yet to introduce measures to alleviate this burden.

Delays in Property Purchase Regulations

A recent proposal requiring mandatory disclosure of income sources for property purchases was delayed in the National Assembly Standing Committee on Finance. This delay has temporarily benefited the real estate sector by allowing property transactions without immediate scrutiny of income sources.

Future Outlook for the Real Estate Sector

Despite ongoing discussions, no final relief package for the real estate sector has been approved. The government must navigate consultations with the IMF and provincial authorities before implementing any policies. Until then, the real estate market remains in a state of uncertainty.

Conclusion

Pakistan’s real estate sector is at a critical juncture. While stakeholders agree on reducing taxes and promoting construction, challenges such as tax amnesty concerns, IMF restrictions, and regulatory shortcomings persist. The coming months will be crucial in determining whether the government can implement a viable relief package without compromising financial commitments and economic stability.

FAQs

1. What is the proposed tax amnesty for real estate in Pakistan? The proposed tax amnesty suggests that first-time buyers of homes, shops, or offices worth up to Rs50 million should not be required to disclose their income sources. However, this has faced opposition from the FBR and IMF.

2. How high are property transaction taxes in Pakistan? Currently, even tax filers pay around 8% of the property’s value in transaction taxes when purchasing property.

3. Why is the real estate sector in Pakistan struggling? The sector is struggling due to high taxes, lack of corporate investment, regulatory issues, and the large informal economy leading to cash-based transactions.

4. What is the government doing to revive the real estate sector? The government is considering tax reductions, abolishing the federal excise duty, offering interest-rate subsidies for home loans, and engaging with the IMF on possible incentives.

5. How will reducing interest rates impact the real estate sector? Lower interest rates can make home loans more affordable, encouraging middle-income and lower-income groups to invest in housing.