Gold Prices Hit Rs304,200 Per Tola as Rupee Slightly Depreciates

Introduction

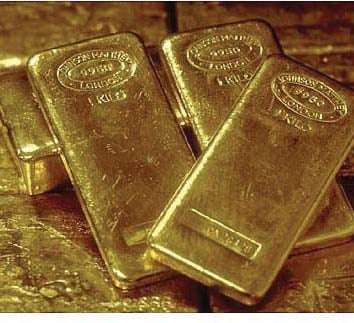

Gold prices in Pakistan have once again surged, following global market trends and rising investor demand. On Tuesday, gold prices increased by Rs1,000 per tola, reaching Rs304,200, while the price of 10 grams rose Rs857, hitting Rs260,802. This continues an upward trend seen earlier in the week, as Monday recorded a Rs1,700 increase per tola.

The price hike isn’t limited to Pakistan—globally, gold prices are witnessing an increase, with the metal trading at $2,910 per ounce, reflecting a $10 rise alongside a $20 premium, as reported by the All Pakistan Sarafa Gems and Jewellers Association (APSGJA).

Why Are Gold Prices Increasing?

1. Global Economic Slowdown Driving Investors Towards Gold

According to Mohammad Qasim Shikarpuri, President of APSGJA, the global economic downturn is compelling investors to seek gold as a safe-haven asset. This trend is not restricted to Pakistan but is occurring worldwide. Investors prefer gold over the US dollar due to financial uncertainty and unpredictable economic conditions.

2. China’s Preference for Gold Over the US Dollar

A significant driver of gold price increases is China’s shift from the US dollar to gold. Many Chinese investors and financial institutions are increasing their gold holdings, causing a global ripple effect.

3. Declining Consumer Purchasing Power in Pakistan

The rising gold prices have made the purchase of traditional jewelry unaffordable for many Pakistanis. Weddings, which typically involve multiple tolas of gold, are seeing a shift. Many families now repurpose old jewelry or buy only minimal gold due to financial constraints.

4. Geopolitical Tensions and Economic Policies

Gold prices are also affected by:

- The ongoing US-China trade war, which has led to higher tariffs on Chinese exports and greater market instability.

- The Russia-Ukraine war, which has intensified uncertainty in global financial markets.

- Anticipation of financial instability, causing investors to shift their capital into gold.

The Future of Gold Prices: Will There Be a Correction?

Despite the rising trend, Shikarpuri predicts that gold prices may correct in the future. He suggests that if:

- Global political stability improves, especially in the Russia-Ukraine conflict

- US economic policies become more predictable

Then, gold prices could experience a downward adjustment.

However, in the current climate, gold remains a safe and liquid investment, making it one of the most reliable options for investors navigating an uncertain global economy.

Rupee Depreciates Against the US Dollar

Meanwhile, the Pakistani rupee saw a slight decline against the US dollar in the interbank market on Tuesday. The rupee depreciated by 0.04%, closing at Rs279.37 per dollar, marking a 10 paisa drop from Monday’s rate of Rs279.27.

Conclusion

Gold prices continue to rise due to economic uncertainty, investor demand, and global financial instability. While the possibility of a market correction exists, gold remains a preferred asset for investors. At the same time, the Pakistani rupee faces ongoing challenges amid global financial pressures.

FAQs

1. Why are gold prices increasing in Pakistan?

Gold prices in Pakistan are rising due to global economic instability, increased investor demand, geopolitical tensions, and China’s preference for gold over the US dollar.

2. How much did gold prices increase today in Pakistan?

On Tuesday, gold prices rose by Rs1,000 per tola, reaching Rs304,200, while 10-gram gold increased by Rs857, hitting Rs260,802.

3. Will gold prices continue to rise?

Experts suggest that gold prices may correct if global stability improves. However, in the short term, gold is expected to remain strong due to financial uncertainties.

4. Why is the rupee depreciating against the US dollar?

The rupee depreciated by 10 paisa due to economic pressures, trade imbalances, and financial instability in international markets.

5. Is it a good time to invest in gold?

Gold is considered a safe-haven investment during economic uncertainty. However, investors should monitor global trends for potential market corrections.